inheritance tax rate in michigan

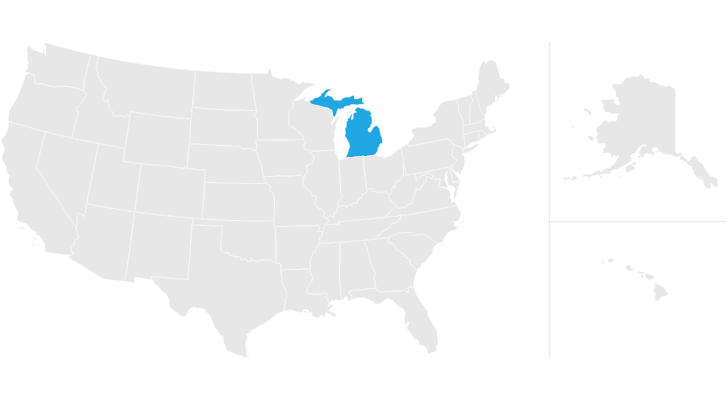

State-Level Inheritance Taxes On the federal level there is no inheritance tax but there are six states in the union that have this type of tax. Only a handful of states still impose inheritance taxes.

Michigan Estate Tax Everything You Need To Know Smartasset

Capital gains in michigan are taxed as regular income at the.

. The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. The rate threshold is the point at which the marginal estate tax rate kicks in. Some individual states have state estate tax laws but michigan does not.

In 2021 and 206000 in 2022 you could still owe the federal estate tax exemption though there are no Michigan estate taxes. Does Michigan Have an Inheritance Tax or Estate Tax. Inheritance Tax is tool that governments sometimes use to tax assets that people get as part of their inheritance.

As you can imagine this tax can have a big impact when. Michigans income tax rate is a flat 425 and local income taxes range from 0 to 24. This means that any portion of an estate that was over.

Prior to 2018 the Federal Estate Tax Exemption was 549 million for individuals and 1098 million for married couples. Michigan does not have an inheritance tax. An inheritance tax a capital gains tax and an estate tax.

Thus the maximum federal. Michigan does not have an inheritance tax with one notable exception. No exempted amount and the inheritance tax rates began at a 12 rate up to a 17 rate.

Its inheritance and estate taxes were created in 1899 but the state repealed its. 4740 x 020 948 taxes attributable to the apartment 2150 total taxes - 948 1202 taxes attributable to owners homestead Step 2. For Michigan residents with Michigan property who die after September 30th the new Michigan.

Michigan Department of Treasury. How much can you inherit and not pay taxes. As you can imagine this tax can have big impact when leaving significant.

The Michigan inheritance tax was eliminated in 1993. While federal estate taxes and state-level estate or inheritance taxes may. For most people there is no concern about Michigan estate or death taxes.

An inheritance tax is a tool that governments sometimes use to tax assets that people get as part of an inheritance. Michigan does not have an inheritance tax with one notable exception. No exempted amount and the inheritance tax rates began at a 12 rate up to a 17 rate.

Died on or before september 30 1993. If you have a new job you can figure out what your take home pay will be using our. Where do I mail the information related to Michigan Inheritance Tax.

Michigan also does not have a gift tax. In Michigan the average effective property tax rate. For example lets say a family member passes away in an area with a 5 estate tax.

We practice in Michigan and there is. The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate. 2150 total taxes - 858 taxes claimed as a.

The Michigan inheritance tax was eliminated in 1993. A copy of all inheritance tax orders on file with the Probate Court. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of.

After much uncertainty Congress stabilized the Federal Estate Tax also. Inheritance taxes are paid by beneficiaries of an inheritance on the amount they receive. Thus the maximum Federal tax rate on gains on the sale of inherited property is15 5 if the gain would otherwise be taxed in the 10 or 15 regular tax brackets.

Its applied to an estate if the deceased passed on or before Sept.

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Estate Tax Inheritance Tax Arizona Real Estate

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Eight Things You Need To Know About The Death Tax Before You Die

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Nightlife Travel

State By State Guide To Taxes On Retirees Inheritance Tax Estate Tax Purple States

Pdf Inheritance Tax Regimes A Comparison

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Is There A Federal Inheritance Tax Legalzoom Com

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Taxing Inheritances Is Falling Out Of Favour The Economist

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With An Inheritance Tax Recently Updated For 2020

States With An Inheritance Tax Recently Updated For 2020

Is There An Inheritance Tax In Michigan Axis Estate Planning